For businesses, the speed and certainty of parametric property insurance can be a game-changer. In today’s volatile climate, where natural disasters are becoming more frequent and severe, the ability to secure immediate funding can be critical to business continuity. Parametric property insurance helps companies mitigate the financial impact of unforeseen events by providing quick access to funds, enabling them to address urgent needs such as repairs, replacements, and operational disruptions. By removing the uncertainty and delay associated with traditional claims, parametric insurance allows businesses to recover faster and more efficiently, minimizing downtime and potential losses.

What Is Parametric Property Insurance and How Does It Work?

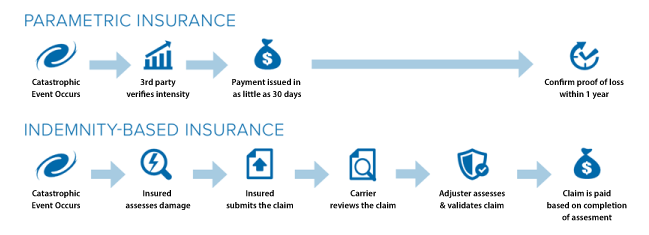

Parametric property insurance is a type of insurance coverage that provides payouts based on predefined parameters or triggers rather than the actual loss sustained. Unlike traditional insurance, which requires an assessment of the damage and a lengthy claims process, parametric insurance uses measurable, objective data—such as the magnitude of an earthquake, the wind speed of a hurricane, or the amount of rainfall in a storm—to determine when a payout is warranted.

This approach simplifies the claims process, allowing businesses to receive funds quickly, often within days of the triggering event, providing much-needed liquidity when it’s most needed.

Speed and Certainty Matter in Today’s Risk Environment

The immediacy of parametric insurance payouts can make a critical difference for businesses facing disruptions due to natural disasters or other unforeseen events. Traditional insurance often involves lengthy claims processes that delay recovery efforts. Parametric insurance eliminates this uncertainty by using predefined triggers, ensuring a faster, more predictable financial response when businesses need it the most.

Unity Captive Solutions and Parametric Insurance

Unity Captive Solutions is leveraging parametric insurance to assist its clients in navigating this evolving risk landscape. By integrating parametric solutions into their captive insurance programs, Unity helps clients achieve a more comprehensive and responsive risk management strategy. This approach provides clients with access to immediate payouts following qualifying events without the need for prolonged claims investigations or disputes over coverage. As a result, Unity’s clients can respond swiftly to disruptions, maintain business operations, and protect their financial stability in the wake of unexpected events.

Simplifying the Claims Process

One of the biggest advantages of parametric property insurance is its ability to simplify the claims process. By using objective data and predefined triggers, such as weather events, businesses can bypass the traditional claims investigation, which often involves detailed damage assessments and lengthy discussions over coverage. With parametric insurance, businesses receive payouts quickly, helping them recover and maintain operations without the wait.

Complementing Traditional Insurance Policies

Parametric property insurance can complement traditional insurance policies, offering an additional layer of financial protection. It can cover gaps that standard property insurance might not address, such as deductibles, exclusions, or non-physical damages. For example, if a business is forced to close temporarily due to a hurricane, traditional insurance might cover physical damage to the building but could potentially have gaps in coverage when it comes to business interruption. Parametric insurance can fill this gap by providing a payout based on the hurricane’s intensity, regardless of whether the property itself was damaged, thus helping the business stay afloat during the recovery period.

The Future of Risk Management

As more companies recognize the value of this type of insurance, parametric solutions, such as those offered by Unity Captive Solutions, are likely to become a vital component of comprehensive risk management strategies. These solutions offer businesses a more resilient and adaptable way to navigate the challenges of today’s insurance landscape, providing swift payouts and filling critical coverage gaps that traditional policies might overlook.

Ready to enhance your business’s risk management strategy? Contact Unity Captive Solutions today to learn how parametric insurance can protect your company and ensure faster recovery from unexpected events.