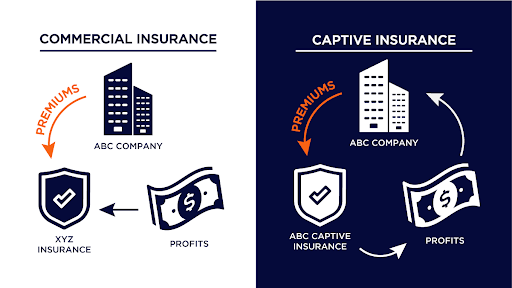

Many company leaders faced with escalating insurance premiums and constrained coverage options are exploring captive insurance as a potential solution. Captive insurance offers companies customized coverage solutions that can lead to significant cost reductions and direct access to reinsurance markets. Let’s look at an example of how you can assess whether captive insurance is right for your business.

Understanding Captive Insurance

Susan Smith, the CFO of a mid-sized manufacturing company (ABC company), had been facing increasing insurance premiums and limited coverage options year after year in the traditional insurance market. She contacted Unity Captive to explore setting up a captive insurance company for her organization. The move was driven by the need for more customized insurance solutions that could potentially lower costs and offer better coverage alignment with the company’s risk profile.

Unity Captive conducted a detailed feasibility study for ABC Company. This study assessed the company’s overall risk profile, financial health, and strategic objectives. It revealed that ABC Company, with its solid capital reserves and favorable loss history, was an ideal candidate for a captive. This insight was crucial, as successful captive operations often hinge on the organization’s ability to support potential financial volatilities.

Key Benefits and Considerations of Captive Insurance

The feasibility study underscored several benefits of forming a captive, including:

● Tailored Coverage: Captives provide specific coverage that meets the unique needs of the business, which are often unattainable in the traditional market.

● Financial Control and Predictability: Captives allow businesses to retain underwriting profits and investment income, offering greater financial control.

● Enhanced Risk Management: With a captive, companies gain more control over claims and can implement a more robust risk management strategy.

However, Susan also recognized important considerations before proceeding:

● Initial Setup Costs: Establishing a captive involves upfront investments. ● Regulatory Compliance: Captives must adhere to regulatory standards, requiring diligent management.

● Ongoing Oversight: Continuous oversight is necessary to maintain the captive’s efficiency and compliance.

How Unity Captive Assists Businesses in Making the Decision

Unity Captive’s role extends beyond conducting feasibility studies. We guide businesses through each step of the process, from evaluating the suitability of a captive to managing the ongoing operations. Our expertise ensures that companies like ABC Company not only understand the benefits and commitments associated with captives but also navigate the complexities of setting up and running a captive insurance company effectively.

Is Captive Insurance the Right Choice for You?

If your business is experiencing similar insurance challenges as ABC Company, it may be time to consider whether a captive insurance company is the right strategic fit. Unity Captive is here to help you analyze your needs, weigh the benefits against the commitments, and ultimately make an informed decision. Reach out to us to discuss how captive insurance can align with your business goals and provide long-term financial benefits.

For businesses interested in exploring captive insurance, contact Unity Captive for a comprehensive analysis tailored to your specific needs, ensuring you make the best decision for your company’s future.